Paypal predict the future of money and it is a “cashless” society:

Ok so this has turned into a bit of a rant. I have some pretty strong thoughts on the global banking crisis and felt like this was a pretty good article title to air those views, be aware that in principle I have no real issue with mobile commerce at all as a conduit to pay for goods and services, and technological advancement.

It is the global credit system that I abhor and unfortunately a “cashless society” aided by mobile technology would potentially escalate and compound the problems that have plagued us since the death of the Gold standard in 1971 and the introduction of “Fiat money” that has been flitting on and off since 1867 to our present time which has caused people of the world so many problems.

Indeed the introduction of “Fiat money” in the past has pretty much related directly to paying for wars, which we all know ultimately make the countries and banks who take part very wealthy as a result, paid for by the god people in blood and sweat.

All while controlling a global populace, and global viewpoint, which usually relates to trade, currency, greed, control and currently crude oil.

History of Fiat Currency here:

New World Order conspiracy theorists will tell you that the agenda of the day currently is a “Cashless society”, why?

Because this ultimately means that you will be using a mobile device to pay your bills and the powers that be will have an ability to track your every move, and have access to data that should help them gain more overall power over you!…..scary..?

“Money – in the traditional sense no longer exists. It died two decades ago when Richard Nixon forever abolished the gold standard. Since then, money as we once knew it has been replaced by an unstable new global medium of exchange that is called ‘megabyte money’… megabyte money is a threat not only to our country’s long-term growth and prosperity, but to the individual as well.”

– Joel Kurtzman, The Death Of Money, 1993

The term “cashless” implies we will not have any money?

Ironically this is what conspiracy theorists will tell you as well!…I digress.

Taking the above people out of the equation, the idea is that you will never really need access to the printed material we know and perhaps love as cash, Dough, Moolah, Rhino, Spondulicks, Readies, Wonga etc etc.

There are many reasons that an agenda is in place to make sure that this happens, and also perhaps quite a few reasons for this huge sea change to be curbed.

So let us look at the “for’s” in more detail:

According to the Chief Executive of Visa Europe, we will all be living in a cashless society by 2012.

Obviously this prediction is going to be way off the mark but it shows that the vision is well and truly in place.

When VISA talk, people listen.

Cashless up to 2012:

The idea had already been described in 1887 by Edward Bellamy in the novel “Looking Backward” a utopian read where the writer used the word “credit card” over 11 times.

Do not begin to think that this is a new idea at all, we have been offering a variant on a cashless system in lots of different disguises since the introduction of credit cards and store cards in the 1920’s.

The US lead the way with a method of buying fuel for the growing number of US car owners – some fuel was purchased via a credit/store card variant around this time, and we all know what happened since.

Banks want to make people owe them cash:

Since the era mentioned above, you could argue that the agenda of many banks, petrol companies, retailers and manufacturers, and in many ways in collaboration, has been to enslave the people of the globe with debt born out of a well marketed, and hyped desire for consumer goods and it has cost us in many, many ways.

Ironically, and perhaps arguably, the most desirable good(s) of the day include the ubiquitous smartphone or similar mobile devices such as tablets, which looks likely to be the every conduit that allows the shift from cash to cashless to take place.

Never think that a bank especially one with links to investment arms (not many left without) wants to loan you cash because they have good intentions, many business who have been left to fail in the last 3 years will tell you that a bank will:

“lend you all the umbrellas you want on a sunny day but never when it rains.”

In fact the way that banks introduced people to the option of credit was done by “drops” or mass unsolicited mailings, and this went on for years to unemployed, wealthy, you name it…many got credit when they could not afford it, as has been the case in the prelude to the last “global crisis”…totally irresponsible lending done to make a small percentage of “untouchables” very very wealthy while the rest of us pick up the tab, with stress, job cuts and increased taxes.

This was for the first credit card scheme as we know today and was done so aggressively that it was banned in the US by the early 1970’s.

“These mass mailings were known as “drops” in banking terminology, and were outlawed in 1970 due to the financial chaos they caused, but not before 100 million credit cards had been dropped into the U.S. population. After 1970, only credit card applications could be sent unsolicited in mass mailings.”

Why do store cards and credit cards work for banks?

One of the reasons that store cards and credit cards work so well for banks as a profit making mechanism, is that psychologically a user never really feels like they have tapped into their bank account when making a transaction.

The pain is removed and felt later, and is never associated with the actual purchase of goods. This helps the retailer and banks make more and more money out of buyers who would perhaps have though otherwise if they had to hand over 1,500 £$€ – etc of the big ones for that TV or sofa that they had to go to the bank to take out….just imagine if that is how you paid for big items still, the cheque was another way of making this potential pain less..mmm…painful.

There is also the astronomical interest served on debt and with interest free options for months and years, many (and they know this) will not be able to pay later as easy as they anticipated or simply mismanage their finances when juggling a record amount of stress and outgoings per month….the result…assuming the person does not go bankrupt is a mass of extra money needed to pay of the initial loan.

And it is the poorer end of society that historically have not wanted to go “bankrupt”, a phenomenon which was tapped into by investment and lending banks when they realised that wealthy people had no moral objection to going bankrupt, and it was the poorer folk that dutifully paid their debts for fear of looking like a leper within their communities.

Back to the cashless society:

Sorry to go off on the global banking system, but I feel so vehemently opposed to centralisation of credit and the way that the globe has gone over the last 30 years that I feel it is my duty to attempt to inform as many people as possible to the evil that the largest of our banks bring to the world.

I do not propose to know everything about global finance, but I have a sensible and open mind and can see that the way banks currently control governments is a step too far and we need to bring banking back to a system that is there for the people as it was originally designed, and seen to be in the eyes of the everyday man.

An example of which is the only bank in the US that has no current debt problems and is operated solely to help its own people by distributing affordable, sensible loans paid for by taxes to aid students and farmers and industry in the area – The Bank Of North Dakota – uses methods of financing projects that “respectable” (remember those) bankers used to be seen doing for business.

The Bank Of North Dakota is not a bank that has any allegiances to the evil of the federal reserve, or the gambling, money grabbing investment banks that have right royally screwed the world over.

Unfortunately these same institutions have now got so many allegiances to most of our high street banks that we find it impossible to escape their greed and idiocy.

Alternative to credit: The barter system:

The people of Greece have already turned to a form of bartering as their nation gets pummelled by the EU and their own government, this is effectively a way of trading goods and services with something of perceived or similar value i.e: lessons in piano for help with gardening, a bag of potatoes for a loaf of bread etc.

Credit is only really available to either help you work more to pay taxes into the system (a car for instance) or to ensure that you go to work because you have that much debt to pay off for “desirable” items such as large TV’s and holidays to the Caribbean, the alternative “bankruptcy” which ironically all banks would be classed as without the serious hard work of the enslaved people of the Western world and wider to bail them out.

Credit is great in theory, but does it not make life a bit false and more troublesome? Surely it would be better if in the end we could simply pay for what we could afford and save for the rest….we really do not need 90+% of what we own and buy on credit surely.

Time to bite off the snake’s head that strangles us daily?

Something has gone very wrong with our society in the West pretty much since I was born in the late 1970’s and I sense that helping our beloved big banks out only goes to ensure that we are indebted more and more to their evil ways…we must make a stand surely?

Money: The Digital Tipping Point:

A report released by Paypal has predicted that consumers will no longer need any cash to shop, no wallet or cards either. Instead they will use their mobile device to pay for transactions, and they expect this to be commonplace by 2016.

M-Commerce is a hot topic:

OK, back to the original topic eventually!

We have covered exciting moves in the m-commerce space and have no issue whatsoever with the move, it makes total sense, my rant above relates to consumers and teh public being very careful with how they go about using a cashless system as dangers will be present for mismanagement and “unscrupulous” institutions such as various banks will try to cash on on this….pun intended.

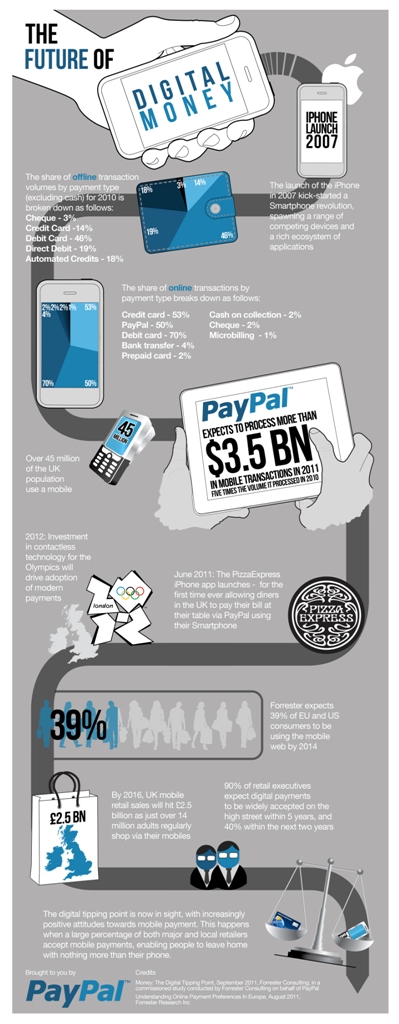

Paypal’s mobile payments report

Carl Scheible, Managing Director of PayPal UK:

“We’ll see a huge change over the next few years in the way we shop and pay for things, by 2016, you’ll be able to leave your wallet at home and use your mobile as the 21st century digital wallet. Our vision of money is to enable you to pay for something from wherever you are, whatever device you’re on – a PC, mobile phone, tablet, games console and a whole lot more.”

“We’re not saying cash will disappear entirely, but we’ll increasingly use our phones and other devices rather than our wallets to pay in-store as well as online”, he says. “The lines between the online world and high street will soon disappear altogether. Children born today will become the UK’s first ‘cashless generation’. It will be completely natural for them to pay by mobile.”

So what Paypal are really saying with gusto is this:

Mobile uptake will be so huge in the next few years that the opportunity for NFC (near field communication) enabled devices to supplant some existing technology as a means of making payments will undoubtedly be on the increase. So will we have a cashless society by then?

Not a chance but by the end of 2020-2025…very possibly….well almost!

If we went totally cashless, the question must be:

How would drug dealers, prostitutes and gangsters get paid?

The rumour is it was the Mexican Drug cartel’s “illegal” cash deposits at Wachovia that helped fund the bank’s exit from the Global Crisis of 2008 when the banking world realised there was no actual money left in the system, only drug dealer had actual “cash”…thankfully!….or not!

For now enjoy: Paypal’s much more beautiful infographic: